Warren Buffett has said he pays a lower tax rate on his enormous income than his secretary pays on her modest income. He thinks that is bad public policy, and so do most Americans. It is widely accepted that tax rates should be higher on those with greater ability to pay and lower on those with lesser ability to pay. In other words, tax rates should be “progressive.” Some argue that tax rates should be the same for everybody, but hardly anyone argues for a “regressive” system.

A new book by Emanuel Saez and Gabriel Zucman reveals how seriously regressive our actual tax system is, and how it has become much more regressive in recent decades. The Triumph of Injustice, W.W. Norton (2019). Saez and Zucman have compiled tax, income, and wealth data for all adults and calculated how they are distributed among income groups. They include federal income taxes, state and local income taxes, sales and excise taxes, residential property taxes, estate and gift taxes, and government social contributions (payroll taxes).

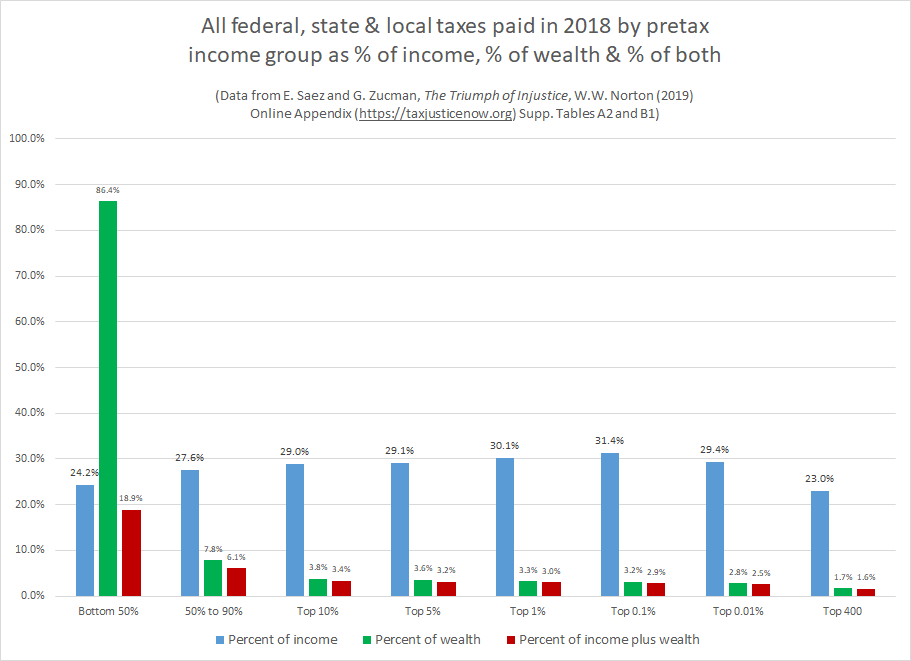

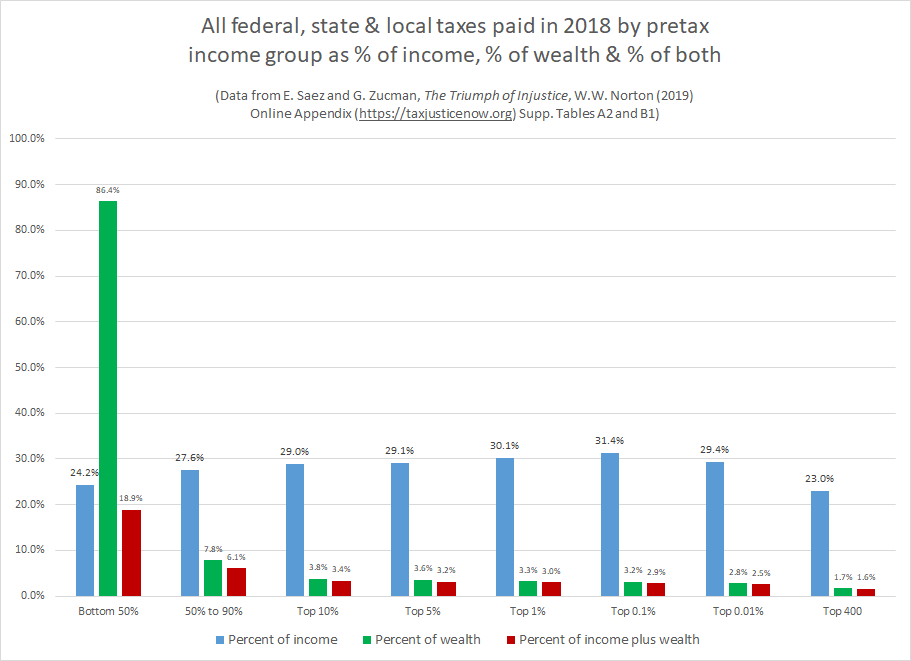

When one looks at all these taxes together as a percentage of income, the system is slightly progressive except within the top 0.1% of earners, where it becomes strongly regressive. Indeed, the top 400 earners (average income $500 million) pay a smaller percentage of their income in taxes (23.0%) than do people in the bottom 50%, who pay on average 24.2%. See the blue bars in the first chart below.

However, ability to pay is even more dependent on wealth—or lack of wealth—than on income. In 2018, taxes paid by people in the bottom 50% of the income distribution were equal to 86.4% of their wealth. Within this group, millions had little or no wealth, or had negative net worth, and paid taxes ten times, a hundred times, or an infinite multiple of their wealth. In contrast, total paid by the top 400 earners were equal to only 1.7% of their enormous wealth. The green bars in the chart above show this highly regressive situation.

Perhaps the most comprehensive way to estimate “ability to pay” is to add income and wealth together. That result is shown by the red bars in the chart above. In 2018, the bottom 50% of earners paid taxes of 18.9% of this comprehensive measure of their ability to pay—12 times higher than the rate paid by the top 400 earners.

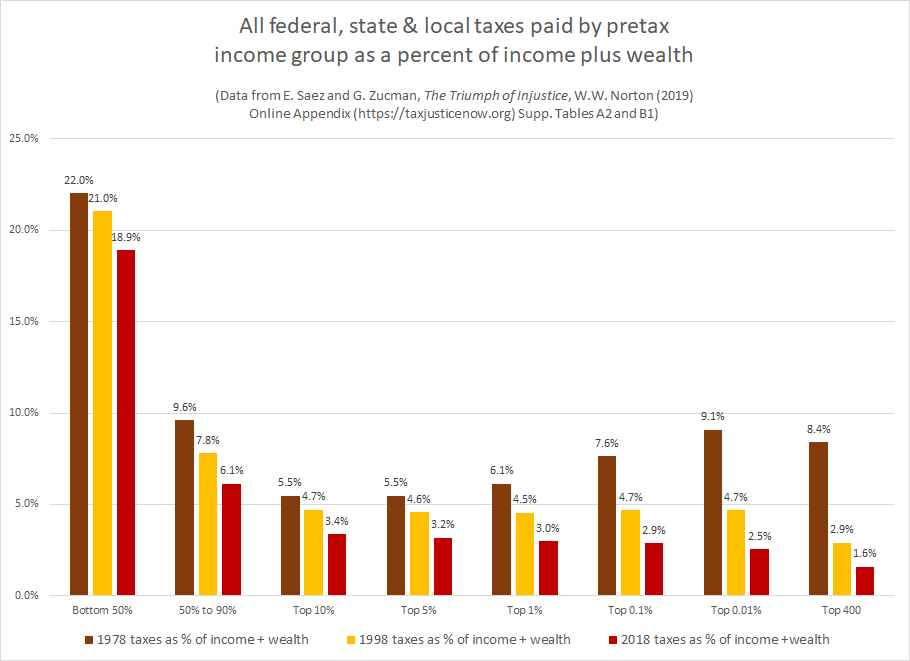

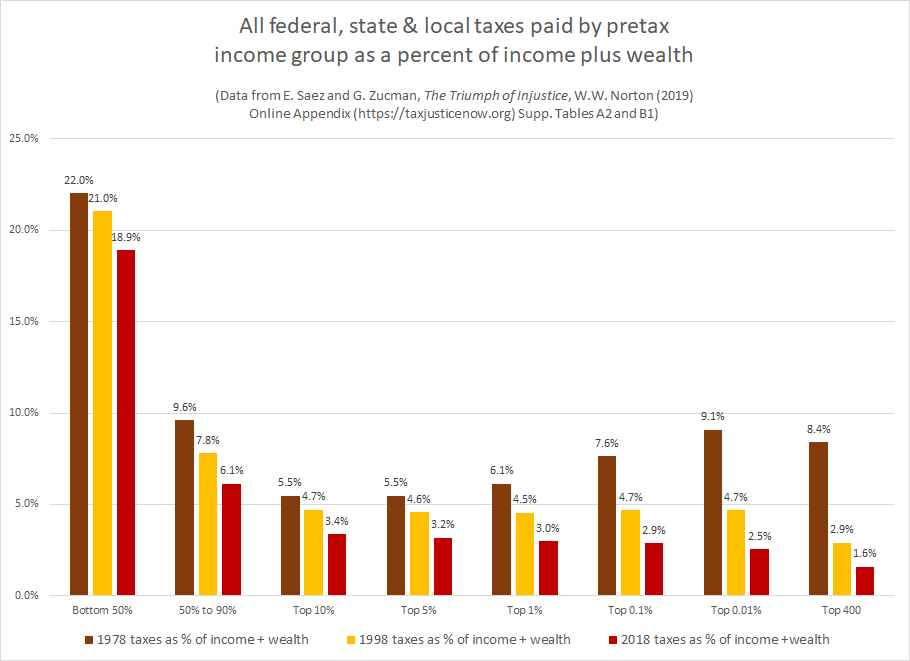

Other data from The Triumph of Injustice reveal that the tax system was much fairer 40 years ago, even 20 years ago. The bottom 50% and the middle class (50-90%) have always paid higher rates than the top 10%, but in 1978 (brown bars in the chart below) there was progressivity within the top 10%. By 1998 (gold bars), that progressivity was gone, and had become regressive for the top 400. In 2018 (red bars), the whole system—from poorest to richest—had become regressive. These changes were not inevitable but resulted from deliberate public policy choices that could now be corrected.

Saturday, February 6, 2021 at 01:26PM

Saturday, February 6, 2021 at 01:26PM