Why We Can't Bring Manufacturing and Innovation Back to America

Monday, January 23, 2012 at 10:38AM

Monday, January 23, 2012 at 10:38AM But as Steven P. Jobs of Apple spoke, President Obama interrupted with an inquiry of his own: what would it take to make iPhones in the United States?

Not long ago, Apple boasted that its products were made in America. Today, few are. Almost all of the 70 million iPhones, 30 million iPads and 59 million other products Apple sold last year were manufactured overseas.

Why can’t that work come home? Mr. Obama asked.

Mr. Jobs’s reply was unambiguous. “Those jobs aren’t coming back,” he said, according to another dinner guest.

The article goes on to explain why the jobs aren't coming back and, more ominously, why our strategically important "innovation" and high tech jobs are following fast on the heals of the low-paid assembly operations. And the innovation jobs aren't coming back either.

There are some bad policies in China, e.g., cheap and abused labor, currency manipulation, buy-local requirements, lavish subsidies of local industries (especially "strategic" industries), illegal barriers to foreign company operations and imports, insistence on technology transfers ("offsets") from non-Chinese companies, and outright theft of information and technology. Some have imagined that with effective diplomacy and pressure, China might, over time, correct its behavior, and then globalization would bring great benefits to the US too. However, the truth is that manufacturing and innovation will continue consolidating in China and other parts of Asia even if all their predatory policies are suddenly reversed. (They won't be.)

That's what many key insiders and experts realize now that they did not appreciate ten years ago. The experiences and views of some of these others are reported in a post I wrote two years ago and the 20 updates to it, and I'm reposting the whole thing below. But first I would be remiss if I did not mention that Paul Krugman won a Nobel Prize for his ideas of "economic geography" and "new trade theory" based on his 20th Century studies of real world data that revealed these dominating patterns of industry concentration and trade that are contrary to the predictions of classical trade theory Ricardian comparative advantage. [Revised 1/26/12.]

[ADDED 1/26/12: Sorry that wasn't very clear. Krugman et al. observed that in the past similar industries tended to be clustered together geographically, and they try to understand why that happens despite increasing transportation costs for raw materials and final products caused by regional concentration. They conclude that successful clusters have real and substantial economic advantages that don't exist for one setting up a competing firm elsewhere. Among these advantages are localized supplier networks, relative abundance of easy-to-find-and-recruit skilled labor, informal "information spillover," supportive local governments, educational institutions, and infrastructure, etc. Once a cluster gets started, it tends to grow like a snowball and become dominant and self-perpetuating. In this 2010 paper, Krugman notes that, with exceptions like Silicon Valley and Wall Street, the clustering effect in the US seems to have become more subtle than it was 50 years ago, but he points out that China is very visibly forming very distinct clusters now in the way that the US and UK did a century ago. So, in the context of this post, New Economic Geography provides a theoretical explanation for the formation and growth of clusters and the great difficulty of competing with them or dispersing them.]

Innovation must be located near manufacturing because so much of innovation is learning from and improving manufacturing, according to GE CEO Jeffrey Immelt on this CNBC forum, The Future of "Made in the USA." Others who understand the innovation process have made the same point. I think I first heard it about 30 years ago from Donald Firth after he left the UK's National Engineering Laboratory in Glasgow. This directly contradicts the naïve view that the US can be the global center of high-skill, high-pay "innovation" jobs and that it makes economic sense for low-skill routine manufacturing jobs to go to Asia. In reality, China can do everything the US can do to assemble the best and brightest in innovation centers, but increasingly only the Chinese can locate them near manufacturing centers.

During and after WWII, the US government provided numerous substantial financial incentives for innovation (favorable tax treatment, government contracts, grants to higher education, etc.), and the many resulting innovations created whole new industries and millions of jobs in the US. However, Government subsidies for innovation make much less sense now—and perhaps make no economic sense at all—because now the odds are that most of the jobs resulting from future US innovations will be created in Asia instead of here. This means that nations like China can get much more bang for their innovation subsidy bucks than can the US because a much higher proportion of the benefits will be in China.

Bad as that is, we're helping our competitor nations by educating more of their students and fewer of our own in America's best universities, and not many of them plan to stay here. Those who still believe the world sees the US as the land of opportunity should recalibrate. A survey of 1,224 foreign nationals from India, China, and Western Europe studying at U.S. universities and colleges - or who had graduated by the end of the 2008 academic year - primarily in engineering, business and economics, computer science and biological sciences, funded by the Ewing Marion Kaufman Foundation and reported here, found:

Just 7 percent of Chinese students and 25 percent of Indian students surveyed said the best days for the United States economy lie ahead.

Approximately 74 percent of Chinese students and 86 percent of Indian students said their home countries' economies will grow faster in the future than they have in the past decade.

Most foreign students said innovation will occur faster over the next 25 years in India and China than in the United States.

Some 76 percent of Chinese students and almost 84 percent of Indian students said it would be difficult to find a job in their field in the United States.

While 58 percent of Indian, 54 percent of Chinese and 40 percent of European students want to stay in the United States for a few years after graduation, only 6 percent of Indian students, 10 percent of Chinese students and 15 percent of European students said they wanted to remain permanently.

Circling back to Jeffrey Immelt, under his leadership GE has located its clean coal technology global innovation center in China. My advice to American teenagers who want to achieve big things in science or engineering: Become fluent in Mandarin and accept the idea of being part of privileged technocratic class in a politically oppressively and highly-polluted nation.

At many top schools, including my own, international students constitute from 30% to 70% of the doctoral candidates in math, physics and chemistry.

The situation might be tolerable, if embarrassing, were it not for recent changes in world economies and attitudes toward science and education. As a result of dramatically increased investment by other countries in science, the brain drain is not just slowing, it appears to be changing direction.

International students and post-docs are returning to their home countries in much greater numbers after reaping the benefits of an American education, and many who have worked for years at U.S. companies and universities are being lured home by offers of new labs, easy access to research funding and the comforts of their native culture.

UPDATE 1/5/10: As relative incomes, wealth, tax bases, and preparatory education systems in the US decline versus China, India, etc., financial pressures on US universities, especially state-supported universities, will lead to admission of an even higher proportion of foreign students. Current events at Berkeley:

The chancellor also decided to gradually increase Berkeley's out-of-state inrollment from 9.5 to twenty percent. Out-of-state students pay more than triple the in-state fees, and the admissions measure would eventually generate an extra sixty million dollars for the campus--while, of course, reducing access for Californians.

UPDATE 7/15/10: The Los Angeles Times reports that Berkeley actually increased out-of-state enrollment to 22.6% and UCLA to 14.9% in this fall's entering classes, all very deliberately to offset decining State government subsidies. The less prestigious UC campuses have lower percentages of out-of-state and foreign students.

It might be pleasant to boast that America is — or should be — a world leader in every area, but the practical reality is that if some other country solves the problem of green energy, so much the better for us.

The subtler point is that a wealthier China, India, Brazil and Indonesia will lead to more customers for new innovations, thereby producing greater rewards for successful entrepreneurs, no matter where they live. There are so many improvements in cellphones these days because there are so many cellphone customers in so many countries.

To put it bluntly, if the United States takes one step back and the rest of the world takes two steps forward, even in purely selfish terms we should consider accepting the trade-off, if only for the longer run. Most of us gain from the wealth and creativity of other countries, even if we can’t always feel like the top dog.

Cowen implies that the benefits of innovation get distributed equally among trading partners and that, therefore, it doesn’t matter where innovations occur and that we can be a free rider on the investments of other nations. I’m pretty sure that’s not how those other nations intend to divide up the benefits. If America does not write for its future a script that does not depend for success on mere slogans like “education” and “innovation,” our future will be written for us by the Chinese. Here’s a preview of what that could be like.

The new Google smart phone may have been innovated in Silicon Valley, but it will be entirely manufactured in and shipped from Taiwan, completely eliminating the American distribution/retail system, according to this LAT report:

In an ambitious bid to expand its reach even to consumers on the go, Google Inc. on Tuesday unveiled the widely anticipated Nexus One smart phone as it launched a bold new business model that could shake up the mobile phone industry.

The Internet giant began selling the phone -- manufactured to its specifications by a Taiwanese firm -- directly to consumers through its website rather than through retail outlets and service providers.

This NYT story illustrates another way in which manufacturing is connected to innovation—venture capital. Asian manufacturers are desperate to get in on the ground floor of innovations because stagnation would endanger their core manufacturing business. (Once everybody in the world owns one of your gizmos, your business is finished unless you can replace all the gizmos with the next new thing.) Therefore, they will outbid US venture capitalists for control of Silicon Valley innovators—i.e., they will take bigger risks and accept the potential of lower returns than the VCs.

The investment arms of large Taiwanese and Chinese manufacturers have created an investment network in Silicon Valley operating under the radar that pumps money into a variety of chip, software and services companies to gain the latest technology. As a result, some Asian manufacturers have proved more willing than entrenched Silicon Valley venture capitalists to back some risky endeavors.

“In the past, the manufacturers would sneak around and get inside information on technology by investing in these companies,” said K. Bobby Chao, the managing partner at DFJ DragonFund China, a business that invests in technology companies in China and the United States. “Now, they’re more involved, more visible and charging after more complex maneuvers.”

. . . .

Asian investments in Silicon Valley present some risks for America’s top technology companies, which could lose their connection to top innovations.

Asian manufacturers like Foxconn or Quanta, as a result, could wrestle away the edge in research and design.

“The manufacturers have gotten more competitive as it relates to innovation, and in some instances they’re already competing directly with their customers,” said Patrick Moorhead, a vice president at Advance Micro Devices, a major PC chip maker.

. . . .

Some former manufacturers have already made the transition and are gaining global brand recognition. Acer and Asustek are Taiwan’s most prominent computer brands, but both companies were contract fabricators for major American companies. Some of their executives steeped in this manufacturing tradition now run the investment arms of the companies.

. . . .

The Asian companies often back projects that Silicon Valley’s financial heavyweights pass on because pay offs are too low and take too long. The Asian companies are “thinking that they didn’t get their fair share of the technology pie in the past,” Mr. Chao said. “Now they have money and will take the risks needed to build up new levels of expertise.”

And this statement from the same article presages Asian companies bringing the innovation effort to Asia, either altogether or at an earlier stage in the development process than Americans would hope.

With $115 million at its disposal, Innovation Works, based in Beijing, has pledged to “build dream teams to collect, analyze, prioritize and execute on the most promising ideas” in the Internet and mobile computing markets.

More anecdotes about top Chinese scientists going home and China's determination to outspend the US on innovation, in this NYTimes piece today:

China’s leaders . . . . are [d]etermined to reverse the drain of top talent that accompanied its opening to the outside world over the past three decades, they are using their now ample financial resources — and a dollop of national pride — to entice scientists and scholars home.

The West, and the United States in particular, remain more attractive places for many Chinese scholars to study and do research. But the return of Dr. Shi and some other high-profile scientists is a sign that China is succeeding more quickly than many experts expected at narrowing the gap that separates it from technologically advanced nations.

China’s spending on research and development has steadily increased for a decade and now amounts to 1.5 percent of gross domestic product. The United States devotes 2.7 percent of its G.D.P. to research and development, but China’s share is far higher than that of most other developing countries.

Chinese scientists are also under more pressure to compete with those abroad, and in the past decade they quadrupled the number of scientific papers they published a year. Their 2007 total was second only to that of the United States. About 5,000 Chinese scientists are engaged in the emerging field of nanotechnology alone, according to a recent book, “China’s Emerging Technological Edge,” by Denis Fred Simon and Cong Cao, two United States-based experts on China.

A 2008 study by the Georgia Institute of Technology concluded that within the next decade or two, China would pass the United States in its ability to transform its research and development into products and services that can be marketed to the world.

“As China becomes more proficient at innovation processes linking its burgeoning R.&D. to commercial enterprises, watch out,” the study concluded.

Here's another example of almost all of the job-creation benefits of US innovation being realized in China. ESolar, a part of well-known technology incubator IdeaLab, is transferring its solar thermal power generation technology to China where all of the manufacturing will be done.

ESolar already manufactures its heliostat arrays in China, and under the terms of the agreement with Penglai it will also build its power plant receivers there. Gross said that ESolar would retain control of the intellectual property behind the technology's design and operation.

Nathaniel Bullard, a solar energy analyst with consulting firm Bloomberg New Energy Finance, said the ESolar deal indicated China was moving aggressively to pinpoint technologies around the world that could help it meet its ambitious renewable energy goals.

"If you're identified by China as a leading technology developer, the technology will be imported with the implication that your technology will over time become local," he said. "You effectively have one stakeholder, the government, which makes development much easier."

Emphasis added. No doubt ESolar will receive a royalty for the use of its technology, probably in the neighborhood of 5%. That means for every $100 of economic activity generated in the manufacture, $95 will enter the Chinese economy through payments to its suppliers, workers, taxes, and payouts to capital, and $5 will enter the US economy through payments to ESolar. As far as I know, other than investment tax credits, there was no US public money invested in ESolar, nor should there be public money invested in similar technology development ventures (or even tax benefits) when the benefits fall so disproportionately abroad.

Here’s an example of how many jobs can be created by successful innovation compared to the small number of jobs involved in the actual innovation:

The Obama administration will announce on Monday funding for nine projects designed to significantly increase fuel efficiency in heavy trucks and passenger vehicles, with more than half the money coming from the $787 billion stimulus package.

. . . .

According to the administration, the nine recipients are expected to create more than 500 research, engineering and management jobs, with 6,000 more positions anticipated when the technologies go into production and assembly.

This investment by USG could be a good deal for America if those 6,000 production jobs were going to be long-term jobs for Americans, but if those 92% of the total jobs created are going to be in China, “American” companies should apply to the Chinese government for the R&D funding.

Here's another example, reported by Tom Friedman, of how innovation centers get collocated with manufacturing. Applied Materials in Silicon Valley makes the machines that make computer chips and photovoltaic solar panels. It has equipped 14 PV plants around the world, generating $1.3 billion in the last year. How many of those PV plants are in the US? None. Five are in Germany (a high wage nation), four are in China, one is in Spain, one is in India, one is in Italy, one is in Taiwan, and one in Abu Dhabi.

Joe Romm, whose post today brought this to my attention, and Friedman also make another good point, that a big reason why PV plants are being built where they are is that national governments have arranged in various ways to make sure there are big and growing domestic markets for PV power generation. (I wonder to what extent those "arrangements" favor domestic manufacture.) China has recently made a big and credible commitment to green power. The US has not. Friedman:

In October [2009], Applied will be opening the world’s largest solar research center — in Xian, China. Gotta go where the customers are.

If America wants to keep the high-paying innovation jobs, it also needs to keep the manufacturing jobs to which they are related, and there also need to be big domestic markets for the manufactured goods. The industrial force can't function with all the generals and colonels here and all of the privates and sergeants an ocean away.

A recent report by Silicon Valley researchers, reported here in NYT, looks beyond the deep recession and high unemployment rates there and sees this (emphasis added):

Even when the trauma of the financial crisis subsides, Silicon Valley will still be at risk because of deeper, long-term challenges, the report said.

Sixty percent of the region’s scientists and engineers are foreign-born, but foreign immigration to the region dropped 34 percent over the last year. The home countries of foreigners are increasingly luring them back, while the United States government’s policies have made it harder for them to stay, the report said.

To combat the brain drain, California must do a better job educating local students, said Stephen Levy, director and senior economist of the Center for Continuing Study of the California Economy, who also serves as an adviser to the annual study. “We’re not going to be able to live on global talent forever,” Mr. Levy said.

However, 5 percent fewer high school graduates are meeting requirements for entrance to state universities, the number of science and engineering degrees has leveled off and state general fund spending on higher education dropped 17 percent last year, according to the report.

Harvard Business School Professor Willy Shih has a pending paper titled The US Can't Manufacture the Kindle, and That's a Problem. Although key parts of the device, including the "ink" were innovated by US companies they outsourced the bulk of the manufacturing value added to Asia. According to Shih, further innovation in these components is now likely to occur where the manufacturing is done. It gets worse. The Cambridge, MA "ink" innovator, E Ink, is trying to sell itself to its Asian manufacturer, which seems to be making more profit on the screen than E Ink is. Mark Muro reported this here in The New Republic. Thanks to Christine for the link.

Boeing's most advanced wing technology--composite constructions--developed in part with US government financing is being offshored to reduce manufacturing costs, according to Charles A. Hamilton in the Seattle Times:

The global alignment of economic power and technology leadership is changing. Boeing has given composite wing technology to its Japanese business partners and outsourced much of its manufacturing to others in the interest of "shareholder value" and the harvesting of its product line. One wonders, in the end, whether Boeing may have set the stage for the destruction of its strategic value to the United States.

Bye, bye, Mark Pinto. The chief technology officer of Applied Materials and the firm's technology center have both moved from Silicon Valley to China.

In addition to moving Mr. Pinto and his family to Beijing in January, Applied Materials, whose headquarters are in Santa Clara, Calif., has just built its newest and largest research labs here. Last week, it even held its annual shareholders’ meeting in Xi’an.

Chinese wind turbine companies are squeezing out Western companies like GE and Vestas, who have superior technology, with buy local policies. Although Western companies are getting royalities on the older technology they have licensed to Chinese companies, a royalty is smaller than a manufacturing profit, and it creates no US jobs. From this Bloomberg report:

Chinese companies have kept costs down by licensing older technology from overseas rivals, including Vestas, Japan’s Mitsubishi and others that sell their own turbines in China.

While the Chinese pay royalties to the foreign firms, those payments don’t come close to making up for the business the foreign companies are losing in China, according to Emerging Energy Research’s Hays.

China’s so-called “buy local” policy steers most state- financed energy contracts to domestic players, said Magued Eldaief, a GE Energy executive who formerly oversaw the Fairfield, Connecticut, company’s Asia Pacific unit.

“There’s no question preference is given to Chinese companies,” Eldaief said. “It’s a reality you have to live with.”

The US is continuing to shift to Asia better and better high tech jobs, according to this NYT report:

[C]omputer scientists, systems analysts and computer programmers all had unemployment rates of around 6 percent in the second quarter of this year, [which is] significantly higher than the unemployment rates in other white-collar professions.

If and when there is a cyclical uptick in US high tech employment, it will probably continue to be overwhelmed by the structural downward trend for this work to be done offshore.

The disappointing hiring trend raises questions about whether the tech industry can help power a recovery and sustain American job growth in the next decade and beyond. Its tentativeness has prompted economists to ask “If high tech isn’t hiring, who will?”

“We are talking about people with very particular, advanced skills out there who are at this point just not needed anymore,” says Bart van Ark, chief economist at the Conference Board, a business and economic research organization. “Even in this sector, there is tremendous insecurity.”

When Immelt said innovation and manufacturing must be co-located it was no slip of the tongue or off-hand remark. He hammers this theme every chance he gets, in this December 2010 CNBC clip, for example.

The domestic printed circuit board industry has departed for Asia, leaving only enough at home to supply the US military. But that can last only as long as the US military doesn't need the latest technology because PCB innovation has moved where the manufacturing is. An interview with Doug Bartlett on his decision to liquidate the oldest PCB manufacturing operation in America is here.

Chinese venture capitalists are becoming big players in high tech and clean tech, and their funding is easier to get than in the US. Climate Progress has the story here. This is a further indication that the notion that America can let go of manufacturing but keep innovation isn't working and can't work.

Dave Johnson's lede today in National Science Board Report: US Losing R&D Jobs To Asia:

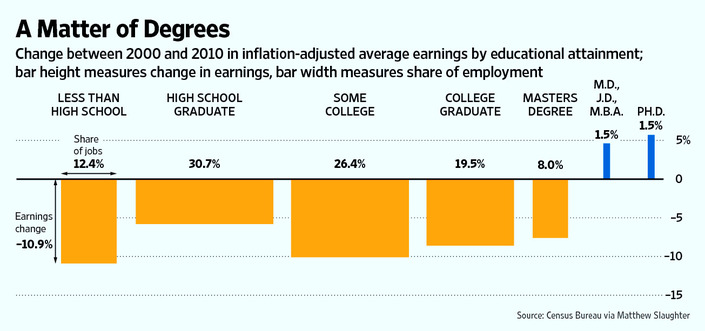

The United States is losing ever more jobs and becoming ever less competitive as our universities are cut back and companies move R&D jobs to Asia. We lost 687,000 high-tech manufacturing jobs lost since 2000. Universities cut back 20% on public research. 85% of growth in R&D employment by American companies occurred abroad.

Skeptic

Skeptic

From the January 2, 2010 repost:

Bad as that is, we're helping our competitor nations by educating more of their students and fewer of our own in America's best universities, and not many of them plan to stay here.

More evidence that this is a recent and rapidly growing trend is reported in this NYT article today, Taking More Seats on Campus, Foreigners Also Pay the Freight.

SEATTLE — This is the University of Washington’s new math: 18 percent of its freshmen come from abroad, most from China. Each pays tuition of $28,059, about three times as much as students from Washington State. And that, according to the dean of admissions, is how low-income Washingtonians — more than a quarter of the class — get a free ride.

With state financing slashed by more than half in the last three years, university officials decided to pull back on admissions offers to Washington residents, and increase them to students overseas.

That has rankled some local politicians and parents, a few of whom have even asked Michael K. Young, the university president, whether their children could get in if they paid nonresident tuition. “It does appeal to me a little,” he said.

. . . .

While the University of Washington’s demographic shifts have been sharper and faster — international students were 2 percent of the freshmen in 2006 — similar changes are under way at flagship public universities across the nation: Illinois, Indiana, Iowa and University of California campuses in Berkeley and Los Angeles all had at least 10 percent foreign freshmen this academic year, more than twice that of five years ago. And at top private schools including Columbia University, Boston University and the University of Pennsylvania, at least 15 percent of this year’s freshmen are from other countries.

All told, the number of undergraduates from China alone has soared to 57,000 from 10,000 five years ago. At the University of Washington, 11 percent of the nearly 5,800 freshmen are from China.

. . . .

Nationwide, higher education financing has undergone a profound shift in recent years, with many public institutions that used to get most of their financing from state governments now relying on tuition for more than half their budgets. But legislators and taxpayers still feel deep ownership of the state institutions created to serve homegrown students — and worry that something is awry when local high achievers, even valedictorians, are rejected by the campuses they have grown up aspiring to.

. . . .

Unlike many other state universities, the University of Washington did no overseas recruiting before this academic year, when it staged recruiting tours in several countries. So the rapid growth in international applications — to more than 6,000 this year from 1,541 in 2007, with China by far the largest source — was something of a surprise. Last spring, another surprise was the percentage who accepted offers of admission: 42 percent decided to enroll, up from 35 percent the previous year.