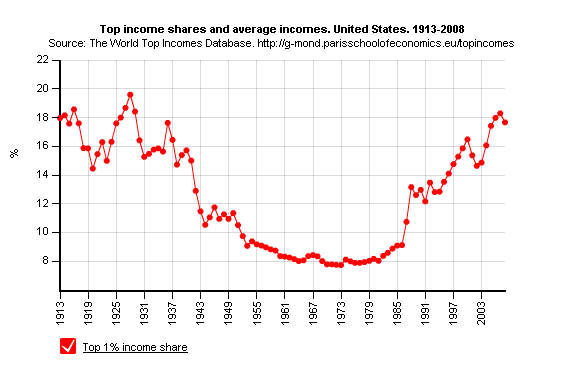

This original expression of Herbert Stein's Law, is sometimes paraphrased as "Trends that can't continue, won't." While Stein used his Law as a reason for government not to try to stop economic trends that are unsustainable anyway, this simple truism is also useful for thinking about how far unsustainable trends can go. For example, let's look at the trend of increasing concentration of income in the top 1% of US households, which exploded from 8% in 1981 to >18% (not including capital gains) in 2007. (h/t David Ruccio at Real-World Economics Review blog)

Clearly, as a matter of simple math, the share of the top 1% can never exceed 100%. Just as clearly, at 100% the other 99% of Americans would have zero income and the "economy" would consist exclusively of the top 1% of households. Donald Trump and Charles Koch mowing each other's lawns, butchering their own steers, and having no security guards while everybody else becomes a hunter-gatherer or dies from dehydration, starvation, exposure to the elements, and lack of medical care? Clearly, then concentration of income at the very top is a trend that at some point will become unsustainable and must stop. We have reached that point, according to Bill Gross, co-founder of one of the world's largest mutual fund debt managers. The incomes of the top 1% come primarily from dividends, interest, and capital gains rather than as salaries and bonuses, and Gross writes this week (emphasis his) that the trend in corporate profits, which have risen from 8% of Gross National Income to 13%, has reached the point of unsustainability.

Clearly, as a matter of simple math, the share of the top 1% can never exceed 100%. Just as clearly, at 100% the other 99% of Americans would have zero income and the "economy" would consist exclusively of the top 1% of households. Donald Trump and Charles Koch mowing each other's lawns, butchering their own steers, and having no security guards while everybody else becomes a hunter-gatherer or dies from dehydration, starvation, exposure to the elements, and lack of medical care? Clearly, then concentration of income at the very top is a trend that at some point will become unsustainable and must stop. We have reached that point, according to Bill Gross, co-founder of one of the world's largest mutual fund debt managers. The incomes of the top 1% come primarily from dividends, interest, and capital gains rather than as salaries and bonuses, and Gross writes this week (emphasis his) that the trend in corporate profits, which have risen from 8% of Gross National Income to 13%, has reached the point of unsustainability.

That there is a current imbalance is obvious from Chart 1 [omitted here], which shows before-tax corporate profits as a percentage of Gross National Income (GNI). It is obvious that "capital" as opposed to "labor" – moving from 8 to 13% of GNI over the past three or even 30 years – has been the cyclical and secular champion. Why one or the other should be policy and politically advantaged is not commonsensically clear. Granted, the return on capital as opposed to the return to labor should logically be higher if only to encourage savings. But once an historical midpoint or range has been established, a relative equilibrium should be observed. Even conservatives must acknowledge that return on capital investment, and the liquid stocks and bonds that mimic it, are ultimately dependent on returns to labor in the form of jobs and real wage gains. If Main Street is unemployed and undercompensated, capital can only travel so far down Prosperity Road. Until recently, economic recovery has been relatively robust if one were a deployer of capital as opposed to the laborer who made that deployment possible. Near zero percent interest rates have allowed profit margins to widen even in the face of anemic end demand. As well, "productivity" has remained high, but only because of layoffs and the production of goods and services with fewer people. While that is a benefit to capital, it obviously comes at a great cost to labor.

Ultimately, however, both labor and capital suffer as a deleveraging household sector in the throes of a jobless recovery refuses – if only through fear and consumptive exhaustion – to play their historic role in the capitalistic system. This "labor trap" phenomenon – in which consumers stop spending out of fear of unemployment or perhaps negative real wages, shrinking home prices or an overall loss of faith in the American Dream – is what markets or "capital" should now begin to recognize. Long-term profits cannot ultimately grow unless they are partnered with near equal benefits for labor. Washington, London, Berlin and yes, even Beijing must accept this commonsensical reality alongside several other structural initiatives that seek to rebalance the global economy. The United States in particular requires an enhanced safety net of benefits for the unemployed unless and until it can produce enough jobs to return to our prior economic model which suggested opportunity for all who were willing to grab for the brass ring – a ring that is now tarnished if not unavailable for the grasping. Policies promoting "Buy American" goods and services – which in turn would employ more Americans – should also be reintroduced. China and Brazil do it. Why not us?

The last time the top 1% got this big a share of income, in 1929, the economy collapsed into the Great Depression, and it took WWII to get us back to full employment and prosperity. Rebuilding US employment is even harder now because outsourcing and globalization seem to give us a "choice" only between even lower US middle-class wage rates or higher unemployment rates. That explains Gross's call for "structural initiatives" such as re-imposing Buy American requirements.