Wages for college graduates in the cross hairs of US business

Thursday, August 2, 2012 at 04:56PM

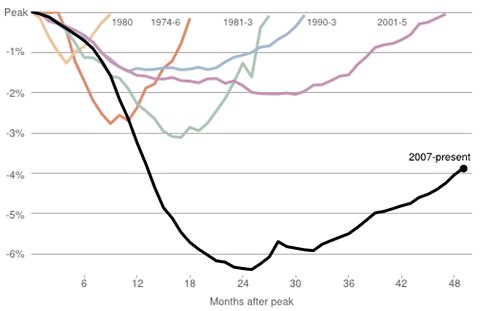

Thursday, August 2, 2012 at 04:56PM Nancy Folbre reports at Economix that fewer than half of recent college graduates are employed in jobs that require college degrees and that their real entry level wages are lower now than they were in 2000. US college graduates are facing stiff competition from foreign workers here under H-1b visas, as well as by offshoring, keeping wages for these jobs depressed.

Further, he [Professor Matloff] observes that high-tech companies insisting that there is a shortage of STEM workers with advanced degrees in the United States don't seem willing to invest much in increased financial support for graduate education.

Maybe college students should seek jobs that seem less vulnerable to global competition, in fields like health sciences. But I just read an article about health care companies sending jobs overseas that gave me palpitations.

The economist Alan Blinder asserts that high educational requirements can make a job more rather than less "offshorable." Most large American companies have already figured this out – but it's not clear how many college students have.

Not only have large American companies figured this out, but Lumina Foundation and the Bill and Melinda Gates Foundation funded a study at Georgetown University's Center on Education and the Workforce to calculate how many more college graduates the US would need to turn out in order to drive down the college-versus-high-school wage premium from 74% to 46%! Yep, that's the plan. Your college education, even in STEM—perhaps especially in STEM—may not be your ticket to a well-paying domestic job.

Skeptic

Skeptic

The same thing is happening in China as millions of young Chinese were drawn away from blue collar work into (mostly second-rate) colleges and now cannot find white collar work, according to Damien Ma and William Adams in Foreign Affairs.

The flip side of the dearth of blue-collar labor has been the glut of recent college graduates that scarcely qualify for work in China’s competitive job market. During the beginning of the market economy era in the 1980s, less than three percent of Chinese young people received a four-year university education. This exclusive cabal of credentialed elites was placed into high flying careers and lived lifestyles befitting their social status.

That was then. College graduates now face a life that would be totally unrecognizable to those a generation earlier, who had the fortune of first-mover advantage. Tripling the size of the higher education system in only a decade has meant a rapid proliferation of new institutions, most of which provide educations -- and professional prospects -- that can’t compare with those of the graduates of the top tier institutions. A massive riot in 2006 illustrated how different the prospects are for graduates of elite universities and those of newer ones: Some graduates of the satellite campus of a university in central China apparently went berserk when they discovered that their diplomas designated them graduates of the satellite, not of the parent university as they were originally promised.

In a situation that would sound familiar to Americans, graduates of new and lower-ranked universities have struggled to find good entry-level jobs. They live in small, crowded, shared apartments at the edge of major cities, scraping by to make rent. The plum jobs for university graduates at state-owned enterprises, in government, or at glitzy multinationals are no more attainable for these young people than for migrant laborers of the same age. And the college graduates won’t take the manufacturing jobs, perhaps to their detriment: average starting wages for college graduates were actually lower than average migrant worker salaries in 2011. Without a good employer to secure their place in urban China, these young people do not simply struggle economically; in many ways, they can be as marginalized from the economic and social fabric of their urban life as are migrant workers.