“Only the little people pay taxes.”

Sunday, January 2, 2011 at 03:15PM

Sunday, January 2, 2011 at 03:15PM Testimony that Leona Helmsley, the Queen of Mean, said this helped convict her of tax evasion in 1989. Similarly, it's mostly true that only US companies that operate exclusively in America bear the full burden of US corporate taxes. The nominal federal "rate structure produces a flat 34% tax rate on [taxable] incomes from $335,000 to $10,000,000, gradually increasing to a flat rate of 35% on [taxable] incomes above $18,333,333." Link. Add State corporate income taxes, and the total nominal income tax burden on corporations operating only in the US is about 39%. Many purely domestic corporations are able to pay effective rates that are somewhat lower by taking advantage of investment tax credits, accelerated depreciation, and other "tax expenditures," but many firms are in kinds of businesses that don't generate such benefits and they end up paying the full nominal rates.

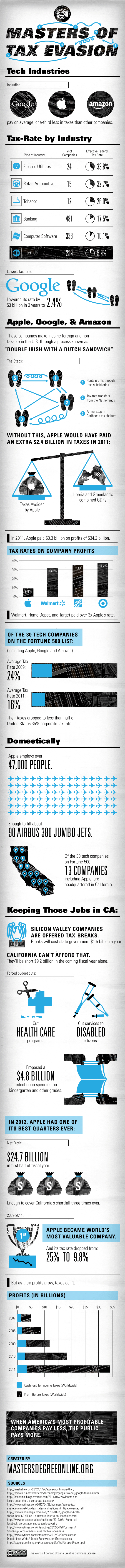

However, the main beneficiaries of our dysfunctional US tax code are multinational companies that can reduce their US tax liabilities to zero, near zero, or sometimes below zero (generating refunds). Thus, while "two thousand U.S. companies paid a median effective cash rate of 28.3 percent in federal, state and foreign income taxes in a 2005 study by academics at the University of Michigan and the University of North Carolina," according to Bloomberg, Google paid only 22.2% total and only 2.4% to the IRS. By using such common devices as the "double Irish" and the "Dutch sandwich," multinationals can arbitrarily allocate their income to low-tax or zero-tax jurisdictions like the Cayman Islands and their expenses to high-tax nations like the US and Western Europe. This isn't just Google; it's standard procedure, again according to Bloomberg.

So here's my question: Isn't it stupid and self-destructive to have a tax code that puts purely domestic American enterprises at a competitive disadvantage with foreign and multinational corporations? Why don't we stop doing this?

Skeptic

Skeptic

In reporting on how difficult it can be to change the Internal Revenue Code, NYT presents a chart of the effective tax rates paid by selected industries. While this analysis of 7,000 public companies by NYU Professor Aswath Damodaran does not distinguish between purely domestic companies and multinational companies, the industries with the highest effective rates are inherently domestic in their revenue sources--electric utilities (33.8%), retail automotive (32.7%), and trucking (30.9%). Lightly taxed industries include banking (17.5%), petroleum producing (11.3%), and drug companies (5.6%).

Skeptic

Skeptic

David Leonhardt in NYT, based on interviews and a paper by Dyreng, Hanlon and Maydew, reports that, averaging over 10 years, cash tax payments by Carnival were only 1.1% of pretax income. Boeing paid 4.5%, and GE paid 14.3%. Of the S&P 500, for which the average was 32.8%, 115 paid less than 20%. The Dyreng et al. paper divided its study sample into 30 industries but did not examine the degree of multinational-ness. However, several industries that appear inherently domestic have the highest effective tax rates. See Table 4.

Skeptic

Skeptic

GE paid no US federal income taxes on its $14.2 billion of worldwide profits or $5.1 billion of declared US profits in 2010. Instead, it got $3.2 billion back from the IRS. This was reported in this NYT article, which goes on to say:

G.E. reported that its tax burden was 7.4 percent of its American profits, about a third of the average reported by other American multinationals. Even those figures are overstated, because they include taxes that will be paid only if the company brings its overseas profits back to the United States. With those profits still offshore, G.E. is effectively getting money back.

Congress declared for 2005 a repatriation tax holiday during which MNCs could repatriate foreign profits they had accumulated offshore and pay a tax rate of only 5.25%. Not surprisingly, there's current talk of creating another holiday for unrepatriated profits that have accumulated since 2005.

GE's tax department employs 975 people and is a major profit center in the company.

Skeptic

Skeptic

Reader Comments (1)

Hard to disagree with you. Until we once again remember “The business of the USA is business” and act politically to make it so we will be at a disadvantage to the rest of the world. It also is ironic to me that socialism as a societal model only appears to be effective in relatively wealthy societies. It is the ultimate check and balance for the politically progressive and anti-business interests in the USA.