The mother of all jobless recoveries

Tuesday, May 11, 2010 at 12:05PM

Tuesday, May 11, 2010 at 12:05PM My purpose here is twofold, to say why recent improvements in labor productivity are probably not a sign of economic recovery and also to applaud Judge Richard Posner for changing his beliefs when the facts change.

In Richard Posner’s new book, A Failure of Capitalism: The Crisis of ‘08 and the Descent into Depression, reviewed here by Robert Solow, Posner says there was a colossal market failure and calls for government action to rein in an out-of-control financial system. Posner has a big and well deserved reputation for promoting free markets, but he seems to have found a situation where the facts don’t agree with the theory and he has elected to go with the facts. What caught my eye today is this blog post in which Posner acknowledges that reported increases in labor productivity can result from offshoring jobs and that this type of productivity increase does not lead to resumption of growth and declining unemployment.

Producers responded to the economic crisis that crested with the collapse of Lehman Brothers in mid-September 2008 by slashing prices and costs. Slashing prices tends to keep output up while slashing costs increases labor productivity (output per unit of labor) because it involves layoffs and (what has the same effect) outsourcing to foreign countries. If all the recent productivity gains had taken the form of outsourcing production, there would be no reason to expect that lower prices would have reduced unemployment even though they would have tended to maintain output and therefore consumption. If higher productivity were achieved by technological advances rather than by layoffs or outsourcing, we would expect it to herald rapid economic growth. If it’s just the result of layoffs and outsourcing, however, it will fall when, faced with increased demand, producers do more hiring.

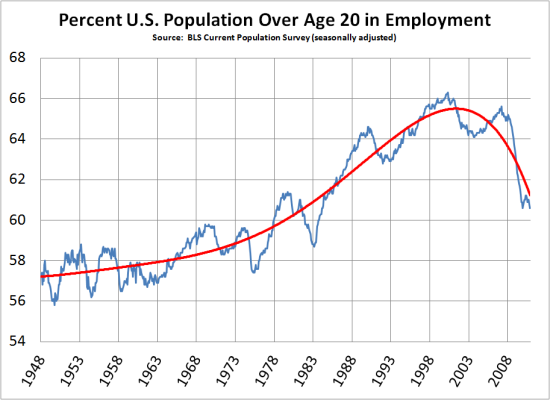

In allowing that productivity increases can stem from layoffs and outsourcing as well as from technological improvements, Posner has departed from the standard supply side, Say’s Law ideology, endorsed, e.g., by Martin Feldstein in There’s No Such Thing as a “Jobless” Recovery in October 2003, which was after the "official" end of the 2001 recession. Despite Feldstein's assurances, it took 39 months to get back to the number of jobs we had before that recession started. Worse than that, because population continued to grow, the percentage of adults employed never did recover to the pre-recession level before we entered the 2007 Great Recession.

From BLS Current Population Survey labor force participation ages 20 plus.

As if that wasn't bad enough, median inflation-adjusted annual family income, which was $61,000 in 2000, had declined to $60,500 before the start of the 2007 Great Recession. David Leonhardt has that story here.

Since I see plenty of outsourcing and very few technological advances being deployed in America--and wages still declining--I expect the mother of all jobless recoveries this time.

Skeptic

Skeptic

Oops. That graph is properly labeled as laborforce participation rate, but that isn't what I said in text. A better indicator of what's been happening--since March of 2000--is a steep downward trend in the ratio of adults working to the total population.

Reader Comments