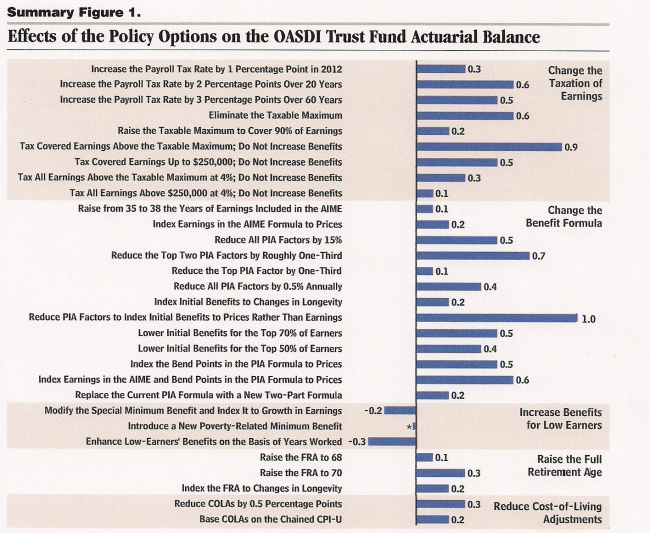

As our political class wrangles about the federal budget deficits and debt, there are persistent wrong-headed proposals to raise the Social Security retirement age and to make annual cost-of-living adjustments ("COLA") smaller. We can restore actuarial balance to Social Security by simply restoring full employment, and if we can't or won't restore full employment we should lower the retirement age and raise the COLA.

The Social Security "Problem"

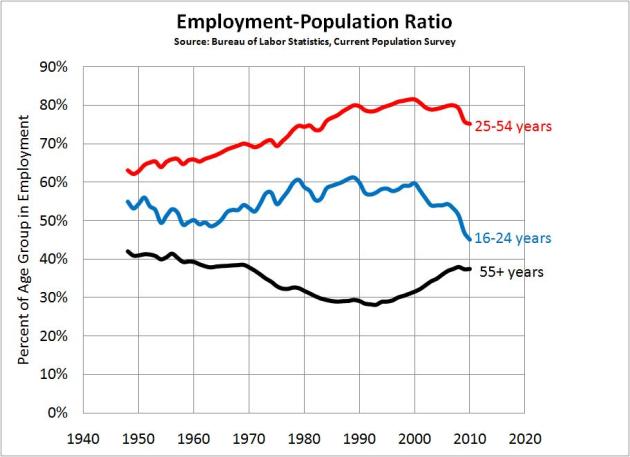

The current problem with the Social Security retirement system is that in recent years taxes paid into the system have been too small, when supplemented by scheduled drawdowns from the accumulated trust fund, to pay all of the scheduled benefits over all of the next 75 years. At present and projected receipt levels, the trust fund will be exhausted in about 25 years, after which current receipts will be only large enough to fund about 77% of the scheduled benefits out to the planning horizon. This is not occurring because nobody noticed that there were a lot of baby boomers who were going to retire but because the percentage of working-age Americans in employment has been unexpectedly shrinking since 2000. Here, courtesy of the St. Louis Fed, is the employment-to-population ratio for Americans 16+ years old.

If the employment-population ratio had continued at the 2000 level, the trust fund would still be increasing, and current receipts plus trust fund drawdowns would never become insufficient to pay presently scheduled benefits. With full employment there is no Social Security funding problem at all. None. All scheduled benefits can be paid for at least 75 years without any tax or benefit changes. In other words, we don't have a Social Security problem, we have an unemployment problem.

In the political arena, we should insist on solving the immediate and devastating unemployment problem and not be drawn into discussing Social Security changes now to prevent a crisis a quarter century from now. If we are going to discuss Social Security at all, we should be demanding changes that make it better for America instead of giving credence to proposals that will both exacerbate unemployment and shrink the safety net.

The retirement age should go down, not up.

The proposal to raise the retirement age is intended to improve Social Security finances by both reducing total benefits paid and collecting more Social Security taxes from seniors who defer retirement. The unintended* but unavoidable consequence of doing that is that senior citizens who keep working will not be making room in the work force for young people, who must then be supported by their parents or some other government program or left in the streets.** This is not a fanciful or trivial problem or one caused by the Great Recession; it has been happening for at least 10 years.

Those 55 and older have been staying in employment longer each year since 1993 and have hardly given up any jobs in the Great Recession. In stark contrast, the employment ratio for 16-24 year-olds has dropped like a rock since 2000. The employment situation for young adults would be improved by lowering the retirement age to get seniors out of the workforce sooner. If there is going to be chronic unemployment, the least bad option is to have unemployed seniors instead of unemployed youth.

The COLA should be changed to CPI-E which recognizes the spending patterns of seniors.

Another proposal to lower the Social Security expenditure rate is to base annual cost of living adjustments on a new consumer price index, "chained CPI." This differs from the currently applicable CPI-W index in that the chained series adjusts the relative weights in the "basket" of goods and services on which prices are tracked to take into account consumers' changes in buying patterns. For example, when consumers can no longer afford steak, they buy hamburger, and when they can't afford that they move successively to bologna and low-protein staples. Thus, a smaller COLA forces lower spending and then (mis)calculates that a smaller COLA enables the beneficiary to stay even. Although the real reason for wanting to move to chained-CPI is simply to reduce Social Security outlays, proponents argue that it is more accurate than CPI-W and therefore fair to everybody. Not so.

If accuracy and fairness is the goal, we should adjust Social Security benefits by an index, CPI-E, which is based on the unique consumption patterns of seniors and has already been developed by BLS. Seniors spend relatively more on health care and housing and less on transportation and education, for example. Switching from CPI-W (which specifically excludes the spending patterns of retirees) to CPI-E (E for elderly) would generate somewhat larger annual increases in Social Security benefits as health care continues to be one of seniors' fastest increasing costs.

Be competent negotiators for a change.

Tactically, those who want to protect Social Security and solve broader economic and social problems, should be demanding a lower retirement age and a switch to CPI-E because the obvious compromise between that and a higher retirement age and chained CPI is the status quo. On the other hand, if progressives only defend the status quo, a compromise with proponents of a higher retirement age and chained CPI is more unnecessary economic and social distress.

_______

* Of course, there are those who fully intend to weaken Social Security because they want to privatize or eliminate it altogether.

** An additional problem with raising the retirement age is how to support senior citizens who don't keep working those extra years. One cost will be that Social Security disability benefit payments will increase. ADDED 8/21/2011: The disability trust fund will be exhausted in 2017 because of burgeoning applications by people who have lost their jobs and are arguably disabled, according to recent estimates.

Skeptic

Skeptic