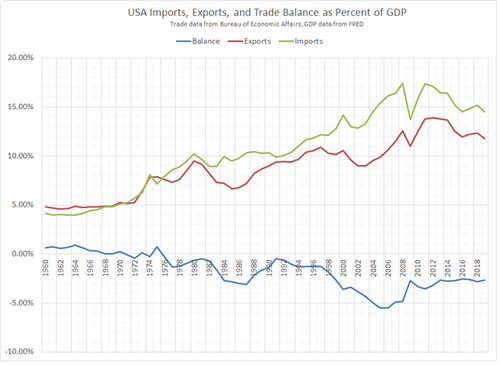

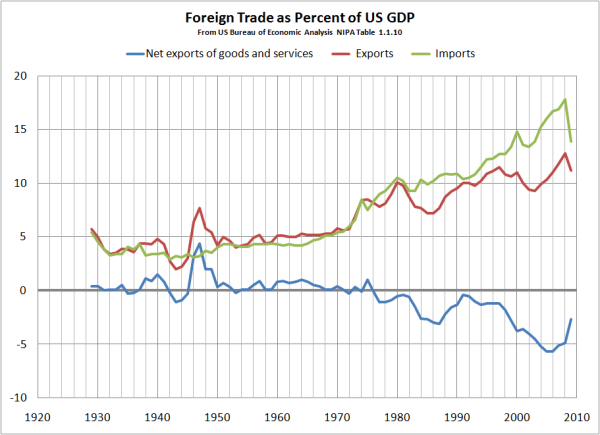

Paul Krugman refutes the myth that US prosperity after WWII resulted from the destruction of our competitors by drawing on the BEA database that generated the following chart. The chart depicts data that also contradict two other myths that pollute conventional wisdom about foreign trade. First the chart and then the myths.

Myth #1: The US economy boomed after WWII because the rest of the world was in ruins.

To the contrary, the chart shows that, except for the war and Marshall Plan years, there was no US export boom until about 1973. Krugman points out that our competitor nations were also our customer nations, and when they couldn’t produce after WWII they couldn’t buy from us either.

Myth #2: The Smoot-Hawley Tariff Act caused the Great Depression, or at least made it much longer and deeper.

This act, signed into law June 17, 1930, was intended to protect American jobs and farmers from import competition by increasing tariffs from historic lows of about 5% to an average of about 25%, levels more characteristic of the 19th Century. Other nations retaliated by raising their tariff rates. Imports and exports both declined, but how much of those declines were caused by the tariff war, and were they a major factor contributing to the Great Depression?

In recessions, imports and exports decline even without changes in tariff rates, an effect that is obvious in the chart for the 1982 and 1991 recessions and the current Great Recession. The chart and database show that exports declined 39% from 5.7% of GDP in 1929 to 3.5% in 1933, the worst year of the Great Depression, while imports declined 37% from 5.4% to 3.4%. However, foreign trade was the smallest part of the US economy in those days, and the largest domestic sectors and the economy as a whole declined even more. Total GDP declined 46% from 1929 to 1933, and the two largest components of GDP, personal consumption and domestic private investment, declined by 41% and 90%, respectively. (The fourth component of GDP, government spending, fortunately declined only 10%.)

If raising tariffs caused immediate foreign trade decreases, then reversing the tariff changes should quickly increase foreign trade by about the same amount, right? Roosevelt promptly began making bi-lateral tariff reduction deals under authority of the Reciprocal Trade Agreements Act of 1934 and average rates were reduced to pre-Smoot-Hawley levels by 1947 when GATT was adopted. See graph here. Can we see the effects on foreign trade? Nope. In contrast to these dramatic tariff changes, the chart shows that imports grew very modestly from 3.4% of GDP in 1933 to just 4.3% in 1951. After that the value of imports as a portion of GDP was stable through 1965 before rising to 6.0% in 1972 (just before the Arab Oil Embargo).

One could reasonably say, as many did at the time, that raising tariffs in 1930 was wrong-headed because it was unlikely to ameliorate the Great Depression (and apparently did not ameliorate it). But there’s nothing in the data to suggest the tariff increases made things a great deal worse either, is there? I submit that the only significant ill effect of Smoot-Hawley was to dissipate the political energy that might otherwise have been directed at doing something useful for the economy in 1930, instead of waiting three more years for Roosevelt and Keynes.

Myth #3: If the US government just stays out of the way, foreign trade will balance itself out and share the benefits among all nations.

According to the chart, the last year the US did not have a trade deficit was 1975, and the average deficit in the 34 years since has been 2.36% of GDP. In the last ten years, the average deficit has been 4.25%. This is important because net exports add to our GDP, and net imports subtract from GDP—that’s not theory or conjecture but in fact how GDP is defined. When we run a chronic trade deficit, we are restricting the growth of our domestic economy—and restricting the growth of wages and salaries that would be earned by Americans if they were producing the goods and services here instead of importing them. The benefits of having an export-based economy are going to other nations, many of whom pursue aggressive mercantilist policies intended to shift into their domestic economies growth and employment that would otherwise occur in the US and other nations.

In 2009, ten nations accounted for 89.6% of the US trade deficit. They were China (45.3%), Mexico (9.5%), Japan (8.9%), Germany (5.6%), Ireland (4.1%), Canada (4%), Venezuela (3.7%), Nigeria (3.1%), Italy (2.8%), Malaysia (2.6%). (Source.) Of these, at least China and Japan overtly engage in currency manipulation and buy-local policies to maintain their advantages. They are, in effect, imposing economic sanctions on us and their other trading partners. This also serves the bottom lines of some powerful US-based interests; for them, a trade deficit is a feature, not a bug. The long-term persistence of our chronic trade deficit shows that it is not a random and transient departure from equilibrium, and it won’t change without policy changes in our federal government.

Skeptic

Skeptic