Skeptic

Skeptic

From my response to an email correspondent who asks about my calculation of 80 cents per gallon and finds it hard to believe that would not significantly reduce demand:

My 80 cents per gallon calculation is just $80/ton x the CO2 yield of one gallon of gasoline (20 lbs.). I understand it is recommended that the carbon price be imposed as far upstream as possible for administrative reasons. I assume that means it would be imposed on the production or importation of crude oil, and at that level $80/ton of CO2 would be about $30-35 per barrel. If owners of crude oil at various stages have enough market power, they’ll try to pass through not only the carbon price but their additional inventory holding costs, but it’s also possible that the whole carbon price cannot be passed through and that producers will have to offset in the wellhead price some portion of the carbon price. So how about 80 cents per gallon at the pump plus or minus 20 cents?

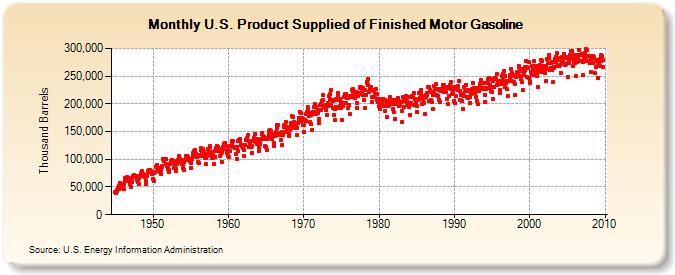

Why would you find it hard to believe 80 cents a gallon would not have significant effect? Crude oil prices reached $147 in July 2008 and gasoline consumption hardly wavered:

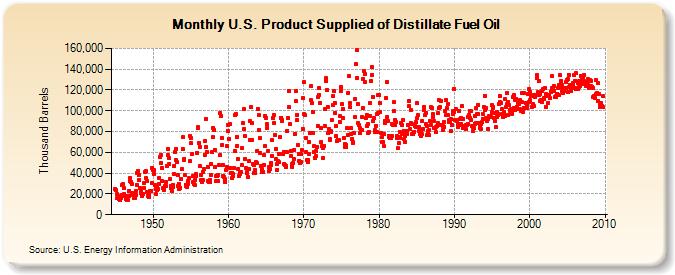

Distillate volumes varied more because they are used in trucks and other businesses which are more sensitive to economic conditions than consumers. The Great Recession officially started in December 2007 and was depressing consumption even before the oil price peaked.

But, you might argue, that’s just the short-term effect; when people understand gasoline will always cost 30% more than they’re used to, they’ll opt for more fuel efficient cars when it comes time to trade. I agree. But, according to OMB, existing CAFÉ standards are going to cause that result anyway. The more fuel efficient cars and trucks will presumably cost more, and the gas hogs will presumably cost a lot more so manufacturers can ration them to make their CAFÉ numbers. Adding artificially high motor fuel prices would presumably push people to choose the same more efficient new vehicles, but they will also be paying more to operate them (nearly $1,000 per year in my calculation). Also, the prices of new fuel efficient passenger cars should be higher than in the CAFÉ-only scenario because people will want those vehicles more and the gas hogs less.

I’m not actually opposed to a carbon price on petroleum products. I’m only opposed to the belief that carbon prices of $50 or $100 or even $200 per ton of CO2 will dramatically reduce the amount of petroleum consumed. I’ve been following this issue for about three years and have read stuff from lots of carbon price proponents and I’ve never seen any analysis with prices, vehicle miles traveled, MPG, etc. that predicts a big reduction in demand. It’s all just arm-waving, which is the reason I wrote this post—to try to get policy grounded in some quantified costs and quantified benefits. Further, squeezing coal out of the mix may INCREASE the demand for distillates, which can after all run gas turbines as well as natural gas. Having the same CO2 price on petroleum as on coal might help mitigate that tendency, and that would be a reason to do it. I think reducing US dependence on oil, especially imported oil, should be a priority—not to prevent global climate change but to put our balance of payments more in order and to reduce the vulnerability of our economy to big petroleum price spikes (which always cause recessions). Reasonable people can disagree about that as a policy goal, but there’s a lot less room for a data-backed argument about the effectiveness of highway fuels prices to achieve that goal, imho.

The closer we get to the real issues, the more interested I get in GCC legislation. Although showing promise, Stavins is still behind the curve in that regard.

There is probably no more important political fact than that carbon pricing is very bad for coal interests, nearly neutral for petroleum, and very good for natural gas. This results from starting by appeasing the god of economic efficiency with a system that generates a single price for all CO2 emissions regardless of source. That leads to the drama in Congress about trying to prevent the shuttering of the coal mining industry and write-off of coal-fired power plants (e.g., by making it possible to substitute “offsets” by “preserving” Amazon rain forests, etc.) and/or obscuring the attack on coal by assigning to the “market” responsibility for determining outcomes (so that elected representatives of the people can deny responsibility for lost livelihoods). A more realistic legislative approach might be to buy all the coal mines and turn them into wildlife preserves and soccer fields.

In support of the first sentence above, consider the following. According to CBO, a price of $191 per ton of CO2 would not reduce consumption of highway fuels at all below what they will be under existing CAFÉ standards. To see why this is so, consider how the $80/ton price recently proposed by Joseph Stiglitz would affect coal and gasoline. A ton of typical steam coal contains about 1400 lbs. of carbon, which will turn into 5,133 lbs. (2.57 tons) of CO2. If CO2 is assessed at $80 per ton, the price of a ton of coal would increase by $205. Since the national average coal price was $31.26 in 2008, that price increase would cause electricity generators to close their coal-fired plants as soon as possible and switch to natural gas, renewables, and (maybe) nuclear.

In contrast, $80 per ton for CO2 would raise the price of gasoline by only $0.80 per gallon (a gallon of gasoline generates ~20 lbs. or 1/100 of a ton of CO2). Obviously, that won't discourage use of highway fuels very much even though it would cost US consumers $110 billion per year in the aggregate. In the US, about 60% of petroleum is converted into gasoline; other major products are motor diesel, jet fuel, home heating oil, and a variety of industrial uses, none of which were addressed by the CBO report; however, I doubt a price increase of 20-30% in these fuels would dramatically reduce consumption of them either, but you use your own business judgment. Bottom line: a price of $80/ton of CO2 could cause an INCREASE in consumption of petroleum products as utilities switch from coal fired units to gas turbines (which were originally designed to burn petroleum distillates, not natural gas, in the stratosphere).

So why does the petroleum industry seem so upset by cap/trade? I suggest they are not really upset but are just routinely opposing and exploiting opportunity. They have a budget and team for federal government relations and will devote it to whatever issues on are on the table, which at the moment includes threatened government “interference” in their business—even if the “interference” might help their business. In contrast to this routine opposition, if you want to see what a petroleum industry full court press looks like, if you want to see the sky over DC darkened by corporate jets and the finance chairs of Senate re-election campaigns worked to exhaustion booking contributions, bring a repeal of the IRC oil depletion allowance close to a floor vote. Furthermore, it is routine in Washington to demand something of value in exchange for any legislative initiative that can be plausibly claimed to have an adverse effect on one's industry. This isn’t a crisis for the oil industry—it’s an opportunity.

From EPA’s most recent report on US contributions to global climate change, using 2006 data: CO2 accounts for 85% of total greenhouse gas emissions, 94% of which come from burning fossil fuels, and about 41% of that comes from coal. If petroleum consumption will not change substantially and natural gas consumption will increase, any aggregate net change must come from reducing coal consumption. Legislation that does not respond head-on to this reality may pave the way to re-election of incumbents but won’t ameliorate the GCC problem.