I'm participating in an email forum on healthcare. It provoked me to think about this more carefully and decide what I think the key problem is. First the question, and then my answer.

Congress is working on broad legislation to change how healthcare is paid for in America and perhaps also how it is delivered. Perhaps because problems are defined in substantial part by analysis of data from the real world, and solutions are largely defined by politics, there is no assurance that the resulting legislative solutions will ameliorate the most important problems. What do you think is the most important problem, if any, with the US healthcare system, and what would be the most effective legislative solution for it?

- The most important problem is that ~15% of Americans are not covered by a plan that has negotiated reduced fees with providers, as a result of which many of them delay/forego important medical services and then require too much expensive ER treatment that is paid for indirectly by those who do have coverage. The best legislative solution would be . . . .

- The most important problem is that medical care is simply too expensive in America because certain parts of the system (which ones?) are overpaid. The best legislative solution would be . . . .

- The most important problem is that many people's access to healthcare is insecure because it's tied to employment, because they have pre-existing conditions, or for some other reason. The best legislative solution would be . . . .

- The most important problem is overutilization of medical services and products that cost far more than their value to particular patients under the circumstances. The best legislative solution would be . . . .

- The most important problem is that providers do not have immediate access to all relevant parts of a patient's medical records. The best legislative solution would be . . . .

- The most important problem is that patients and/or providers have suffered a loss of liberty because they are only cogs in a vast bureaucratic machine. The best legislative solution would be . . . .

- The most important problem is that the federal government is already too much involved in healthcare; we would have better healthcare and/or lower costs if the government's role were reduced or eliminated. The best legislative solution would be . . . .

- The most important problem is that the quality of healthcare available to Americans who can afford it is not improving as fast as it could. The best legislative solution would be . . . .

- The most important problem is a shortage of primary care givers and an oversupply of specialists. The best legislative solution would be . . . .

- The most important problem is none of those but is ____________________. The best legislative solution would be . . . .

Skeptic answers:

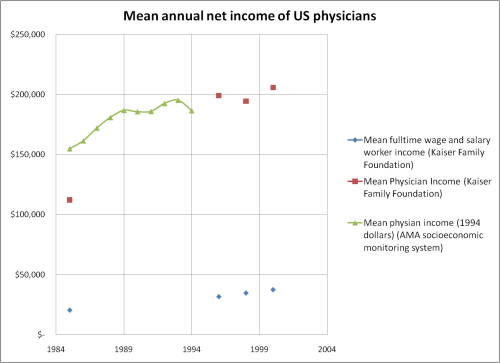

#2. The most important problem is that medical care is simply too expensive in America because certain parts of the system (which ones?) are overpaid. I don't know which specific parts are "overpaid," maybe all of them compared to what their customers can afford. I am mindful that my "cost" is somebody else's "revenue," and that cost reduction necessarily means income reductions for people in the healthcare system. But we need to do that, and if it isn't a bloody brawl we didn't do it right.

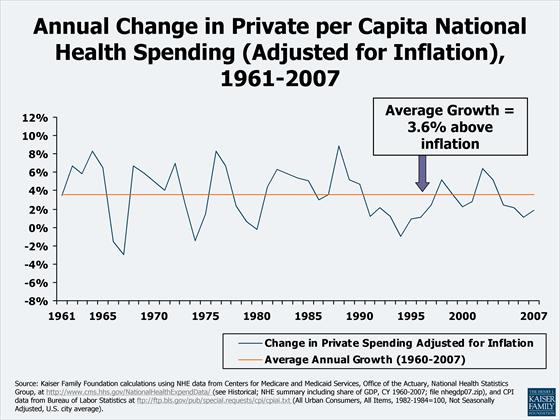

This chart from the Kaiser Family Foundation, via Ezra Klein, shows that real American per-capita healthcare costs have risen at an average annual rate of 3.6% since 1960.

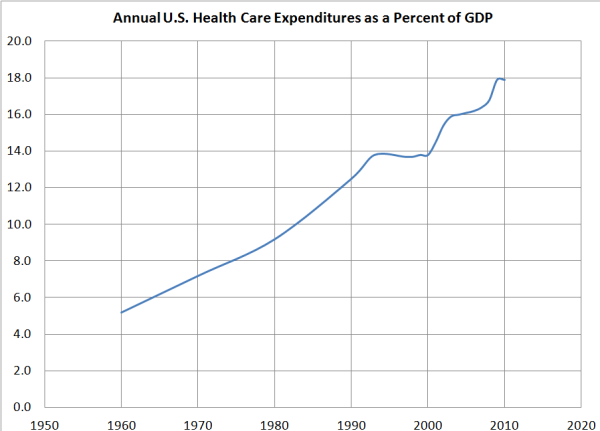

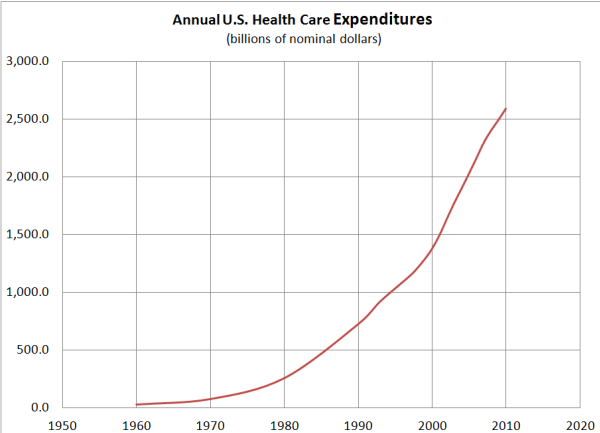

At 3.6% per-annum growth, per-capita healthcare costs double in 20 years (Rule of 72) and redouble in another 20 years. That's how US healthcare costs have gone from 7% of GDP in 1970 to 15.3% in 2004 and to 17.6% in 2009. [Please see 7/23/2012 Update for more complete data and a working link.] There is no evidence that we are 2 to 3 times healthier as a result.

In stark contrast, average real hourly earnings for the 5/6 of Americans in the private workforce who are not bosses have not changed since 1973.

Some say the reason these money incomes stagnated is that increasing costs of employer-provided healthcare gobbled up potential wage increases. Probably that was one of the causes, but I have no data. If middle class money incomes had increased at the same rate as healthcare costs, hardly anybody would think there is a healthcare crisis today. But they didn't, and there is.

Hello, healthcare system, your customers can't afford what you're selling! Not even with taxpayer subsidies because the taxpayers are mostly the same folks who can't afford to pay you directly. When 5/6 of your customers have had on average no income increases you cannot get more revenue from them unless they spend less on other things—things like the 2/3 of their incomes that typical families spend on rent, food, and transportation. So how has it been possible for the healthcare sector to keep growing like a cancer? Because markets don't work in healthcare. Prices are administered. Even the fraction of aggregate personal income that is steered into healthcare is administered. Administered by Congress, Medicare authorities, insurance companies, drug companies, hospitals, and employers, rather than being negotiated between patients or groups of patients and providers. There are few normal downward sloping demand curves in healthcare, which is nicely illustrated by the counterpoint that there is effective price competition for LASIK surgeries and other procedures not generally covered by insurance.

Increases in Medicare Part B (outpatient services) reimbursements are limited by law to changes in the CPI, but Congress waives that every year and allows larger increases. Medicare Parts A (hospital services) and D (drugs) have no such limit, and Medicare authorities are forbidden by law to negotiate drug prices. Even the income differentials among medical specialties are lobbied rather than set by market forces. There is general agreement that we have too few primary care physicians like pediatricians and gerontologists and more than enough of some of the higher-paid specialties, whose work seems to expand to consume any amount of resources without reducing prices. Yet, nobody seems able to increase reimbursements for primary care physicians and reduce them for specialties that may be overpopulated. (How American Healthcare Killed My Father in the Atlantic provides a credible overview of this and other problems in the system.)

Since I see no prospect for functioning markets in healthcare, I'm just focusing on how to administer better. The best legislative solution would be for Congress to impose uniform rules on health insurance similar to those for Medigap policies: Everybody is eligible (no pre-existing conditions or employment status considered) during annual open enrollment periods, and insurers have to offer standard contracts. This would eliminate underwriting costs and force insurers to compete on price for identical products. Add a public option, and private insurers would really have to get busy turning themselves into austere public-utility-like transactions processors and eliminating things like "innovations" in marketing and claims denial that give no value to patients. Taxpayer subsidies for non-standard Medicare policies should be eliminated.

Congress should also stop waiving every year the law that requires increases in Medicare reimbursements to be limited to inflation and should repeal the provision that forbids Medicare from negotiating drug prices. Provider incomes must stagnate and go down along with their customers' incomes. But that doesn't mean they'll be worse off because, just like the working and middle classes whose incomes have already stagnated, the professional and managerial class will still enjoy hedonic improvements in the goods and services they are able to buy with their stagnant money incomes. ;-)

Will drug companies stop developing and making drugs if US selling prices come down? No, but they may raise their prices to Canadians and Europeans when Americans stop subsidizing them, which would be fine with me.

Will there be too few docs if their real money incomes stagnate and even shrink? No. What else are they going to do? Write novels? Emigrate to Canada? Go straight from college into the labor force? Become lawyers? US docs are paid way more than their counterparts in other OECD countries, and if necessary we can open the immigration doors a little wider to foreign docs. If we're going to have globalization and wage convergence, every American should face vigorous foreign price competition, not just the working class and middle class whose lobbyists failed them.

Will providers stop taking Medicare patients? No, they can't. (Well, mine might, but in the aggregate, no.) About one-third of all patients are on Medicare, Medicaid, or some other government-paid program. If those patients are not treated somewhere in the system, there are going to be an enormous number of underemployed medical professionals beating the bushes for salaried jobs or some other source of revenue or offering big discounts to insurers in order to fill their schedules.

Maybe our cost cutters will overplay their hands and have to retreat occasionally. That's OK. You never know where the price line is unless you go over it occasionally.

Do I think this will happen to any significant degree? No. What needs to be done would be very painful to the healthcare industry, which owns all parts of Washington, DC not owned by Wall Street. For me the most telling sign that a healthcare bill on the President's desk is a bad bill is that the health insurers let it get there—if they do.

I would not enact a mandate for 45 million uninsured Americans to buy into this broken system. If the cost problem is not fixed first, the mandate would be worse than a tax; it would deliver people into the hands of insurance companies that view them as legitimate prey. Furthermore, a mandate would probably fail. The Senate Finance Committee markup bill requires families with annual pre-tax incomes over $66,000 to purchase insurance without any taxpayer subsidies. Since insurance for a family costs on average almost $13,000 (other sources say more) and would be an incremental family budget item of about 25% of after-tax income, Congress might as well require pigs to fly!

Skeptic

Skeptic