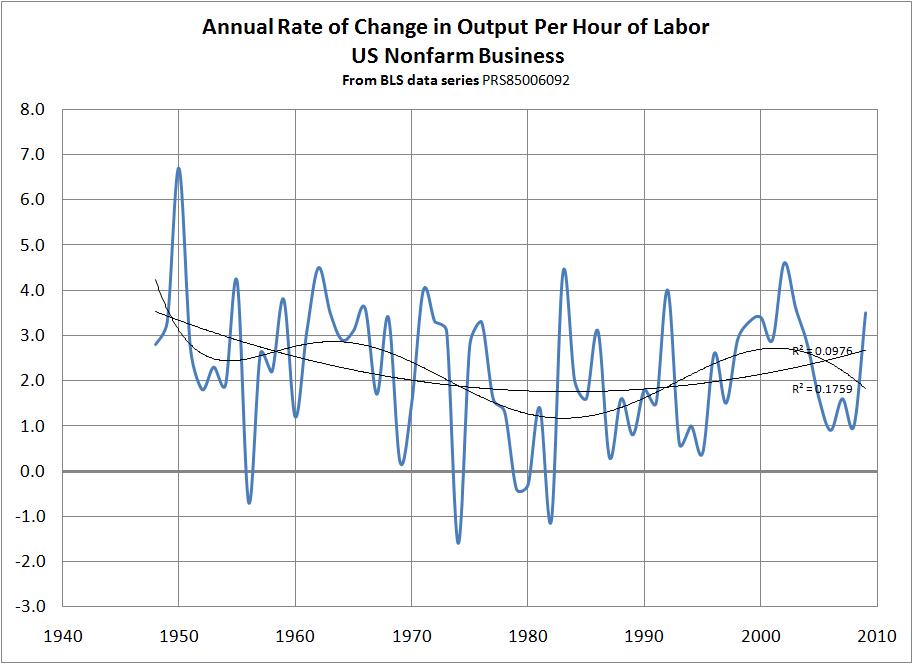

The US has had a decade of declining rates of employment, stagnant wages, and flight of talent and innovation. Meanwhile, China enjoyed the opposite. In the bilateral talks going on Washington this week, the US intends to push (again, for the umpteenth time) for China to phase out its FOREX interventions that keep the value of its renminbi low versus the dollar because, we say, that gives Chinese companies and workers an unfair price advantage versus US companies and workers in foreign trade. This is not the only mercantilist policy that China has pursued and may not even be the one most damaging to US interests, but it has gotten the most attention. Yesterday, The News Hour broadcast a Paul Solman interview with two professors who explain the Chinese position on the currency issue.

Professor Geng Xiao, Director of the East Asia Global Center in Beijing, and an honorary Professor at the University of Hong Kong, explains the Chinese view that there is an ongoing natural convergence between the US and Chinese economies in terms of incomes, wage rates, employment rates, growth, inflation, etc.:

GENG XIAO: Basically, the Chinese income is rising. Chinese price levers are rising. And the U.S. income is stagnating, right? So the two are converging. And that's what we expect. And this is what will happen, no matter what the Chinese government wants or not. So, if we just have a little bit more patience, everything will actually fall into places.

Professor Yasheng Huang of the MIT Sloan School of Management says the only problem is that Americans have a borrow-and-spend mentality that would persist no matter what the exchange rate is. American consumers must change their profligate ways, and there is no good reason for China to make any policy change.

PAUL SOLMAN: So, if China's goods were more expensive than they currently are, you think the United States would still be borrowing money?

YASHENG HUANG: From India, from Vietnam, from Brazil. I'm not saying I agree with the Chinese completely. All I'm saying is that it is very difficult to make the argument with the Chinese and say, you do something about your exchange rate, but, by the way, we can spend the way we want, right? So, that's a -- that's not a winning argument with anybody.

It isn't only the Chinese who think US wages should decline to the level of rising Chinese wages. Neoclassical economists see the world this way too and see the solution to chronic US unemployment, trade deficits, and the hollowing out of the middle class as still lower US wage rates. As long ago as 2008, top Democratic economic policy guru Robert Rubin was reported to be troubled by the human effects of convergence, but not troubled enough to suggest US policy changes.

How much does the US wage level need to decline according to this view? Edward Hadas, Martin Hutchinson, and Anthony Currie say:

American workers are overpaid, relative to equally productive employees elsewhere doing the same work. If the global economy is to get into balance, that gap must close. . . . It's possible to run the numbers to show that American manufacturing workers should take average real wage cuts of as much as 20 percent to get into global balance.

The fact that our US government keeps moving in this direction with bipartisan support makes my blood boil.

Wednesday, April 13, 2011 at 11:09AM

Wednesday, April 13, 2011 at 11:09AM